- 16.12.2025

- News

- Blog

Taxation of tobacco products: the Federal Council's flawed approach

In Switzerland, the taxation of tobacco products is a veritable mess: each product category is taxed very differently, without any coherent public health rationale, and with significant disparities that create market distortions.[i]

from Luciano

The taxation of cigarettes, in particular, has been completely frozen since 2013, with Parliament systematically rejecting any significant increase. While retail prices have risen in recent years, this is solely due to increased profit margins that go directly into the industry’s pockets, without any benefit to public health or tax revenues.

During the September 2025 parliamentary session, three parliamentary motions were finally submitted to address the blatant under-taxation of certain products, which effectively constitutes a tax privilege for some tobacco companies and their most problematic products. On 26 November 2025, the Federal Council issued their response: they rejected all three motions with a series of arguments ranging in soundness from questionable to downright ridiculous.

We examine below the elements of the Federal Council's responses that appear insufficient, unfounded, or contradictory with regard to public health objectives and fiscal consistency.

Abolish the tax privilege for heated tobacco products, the new cash cow of the tobacco industry

Currently, heated tobacco products[ii] are taxed at only 16%, compared to 50.1% for traditional cigarettes. This difference stems from the fact that, under the Tobacco Tax Act, heated tobacco sticks are classified as "other tobacco products". However, this classification is arbitrary and lacks any basis in health, tax, or economic considerations: these sticks are designed for the same use as cigarettes, induce comparable addiction, and pose well-documented health risks. For the sake of consistency and tax fairness, they should therefore be subject to the same level of taxation as combustible cigarettes.

In their response to the motion by National Councillor Giorgio Fonio, who requested that heated tobacco products be subject to the same tax rate as cigarettes[iii], the Federal Council reiterate several classic arguments used by the tobacco industry to oppose any tax increase. In particular, they invoke the spectre of illicit trade and the myth of "harm reduction", two arguments frequently used by manufacturers to block tax measures that are nevertheless essential for public health.

First, the Federal Council assume that taxing heated tobacco products at the same rate as cigarettes would automatically lead to a sharp increase in prices. This assertion is neither proven nor self-evident. Let's take a concrete example: in France, heated tobacco products are taxed at 51.4% (compared to 55% for cigarettes). Despite this, the prices remain very comparable to those in Switzerland. A pack of Terea sticks costs approximately €7.20[iv] in France, while it is sold for around CHF 8.50[v] in Switzerland. In other words, Terea are already significantly more expensive in Switzerland, even though the tax rate here is much lower.

The current price difference therefore does not reflect taxation, but rather the considerable profit margin realised by the manufacturer. If taxes were to increase in Switzerland, it is highly likely that a substantial portion of this increase would be absorbed by this profit margin, reducing the impact on the final price for the consumer.

It should also be noted that several heated tobacco products are now competing on the Swiss market, despite the current dominance of PMI products. In a context of higher taxation, this competition would exert natural downward pressure on prices, a factor that the Federal Council are not taking into account.

Screenshot AT Suisse

Image 1: Price comparison for a carton of 10 packs of Terea Sticks (200 sticks): top left: on the website https://tabak.kkiosk.ch, a pack costs CHF 8.50 here (but if you buy more, you get immediate discounts); bottom left: on European website https://smog-store.com (for delivery to all countries around Switzerland), a pack costs €7.20; on the right: on the Zurich Airport Duty Free website https://zurich.shopdutyfree.com, a pack costs only CHF 4.72.

Far more significant than cross-border shopping, one of the main factors contributing to tax revenue loss stems from the considerable volume of goods sold in duty-free shops. Unlike purchases made abroad, sales in duty-free zones take place within Swiss territory, in a perfectly legal framework, but they largely escape tobacco taxation. Switzerland therefore voluntarily forgoes significant tax revenue on products that, in most cases, will be consumed in Switzerland after travellers return (at Swiss airports, passengers are always required to pass through duty-free shops upon arrival, where they can purchase tax-free goods).

This situation creates a twofold problem. On the one hand, it provides the tobacco industry with a highly profitable distribution channel where taxes are minimal and discounted prices encourage consumption. On the other hand, it undermines the effectiveness of our tax policy: while the Swiss government justifies the low taxation of heated tobacco by citing fears of alleged illicit trade or excessive price increases, it simultaneously tolerates a system that allows the purchase of Terea sticks for less than CHF 5 per pack—almost half the price of regular retail outlets.

At a time when heated tobacco products are experiencing explosive growth in the Swiss market, ignoring the role of duty-free sales amounts to leaving a major tax loophole open. A coherent tax reform therefore cannot overlook this sales channel: harmonising prices and banning the duty-free sale of tobacco and nicotine products would be essential to restore tax equity, reduce incentives for consumption, and prevent hundreds of millions of francs from continuing to escape tobacco taxation every year.

An increase in taxation on heated tobacco products would not automatically lead to a significant increase in prices, as the Federal Council assume

For decades, the tobacco industry has invoked the threat of illicit trade to oppose any tax increases or stricter regulations, but this rhetoric is largely a form of strategic disinformation[vi]. Numerous independent scientific analyses show that properly implemented tax increases do not automatically lead to an increase in the black market; on the contrary, it is primarily factors such as corruption, weak customs controls, or political tolerance that determine the extent of illicit trade[vii]. A systematic review published in Tobacco Control demonstrates that the argument "more taxes = more smuggling" is a central and recurring element of industry lobbying, as is the claim that tax revenues would decrease or that consumers would massively switch to illegal channels. Several studies also show that the data presented by cigarette manufacturers to support these claims are heavily biased, systematically exaggerating the size of the illicit market compared to independent estimates. Research conducted by the University of Bath reveals that industry-funded reports use opaque and non-reproducible methodologies, often designed to artificially inflate the figures[viii]. Other reports highlight that, paradoxically, the industry itself has been involved in or profited from the illicit trade, which further reduces the credibility of its claims. International organisations such as the WHO, as well as specialised institutes like Tobacconomics, confirm that countries with high taxes are not the ones experiencing the most smuggling, and that the industry's argument is primarily aimed at delaying or preventing effective tax policies[ix]. In summary, the bogeyman of illicit trade is less a reality than a lobbying tool designed to protect the profits of the tobacco industry and deter governments from adopting public health measures whose effectiveness has been proven.

The threat of the development of a black market is a classic argument used by the tobacco industry, but it is much more of a manipulation than a reality

In addition to these general considerations concerning traditional cigarettes, it is essential to remember that the black market for heated tobacco sticks is completely nonexistent in Switzerland. The production of these sticks is far more complex than that of a traditional cigarette: it requires specialsed machinery, technology for cutting and reconstituting the tobacco, and specific materials. Furthermore, the tobacco used in these sticks is highly processed and contains numerous chemical additives that are very different from those used in traditional cigarettes. Producing counterfeit sticks would be costly and unprofitable for criminal networks.

To date, we have not identified a single case of counterfeit heated tobacco sticks in Switzerland. A few seizures have been reported in some Asian countries, but these are very limited exceptions involving very low-quality products that have not gained a foothold in European markets.

In Switzerland, the black market for heated tobacco products simply does not exist; the argument of illicit trade put forward by the Federal Council to refuse a tax adjustment therefore has no factual basis

The "harm reduction" argument, widely promoted by the tobacco industry, also seems to have crept into the Federal Council's response: "Furthermore, higher prices can also encourage smokers to reduce their tobacco consumption, switch to less harmful products, or quit smoking altogether." But which "less harmful products" are the Federal Council referring to? The industry has been claiming for years that heated tobacco is significantly less dangerous than cigarettes. This is false: it is a central element of the industry’s marketing strategy, based on biased data funded, produced, and published by the manufacturers themselves.

Let's reiterate an essential point: tobacco taxation in Switzerland has – unfortunately – no public health objective, as the authorities constantly remind us. But if that were the case, and if the danger of the products were to be taken into account, then heated tobacco products should be taxed at exactly the same level as cigarettes, since the associated risks are comparable. Heated tobacco products are often presented by the industry as "much less harmful".[x] This claim is not supported by any high-quality independent studies. Truly independent analyses, on the contrary, show that HTPs release numerous toxic substances, are highly addictive, and can lead to serious illnesses, just like combustible cigarettes. The industry, however, continues to perpetuate the myth of "95% less harmful", relying on figures from its own internal studies—studies that have been widely criticised for their methodological biases, lack of transparency, and obvious commercial motives[xi].

Heated tobacco is no less dangerous than traditional cigarettes. The idea that these products are "reduced-risk" is a myth constructed, maintained, and disseminated by biased studies funded or directly produced by the tobacco industry.

Heated tobacco products: Switzerland deprives the state of more than CHF 225 million every year

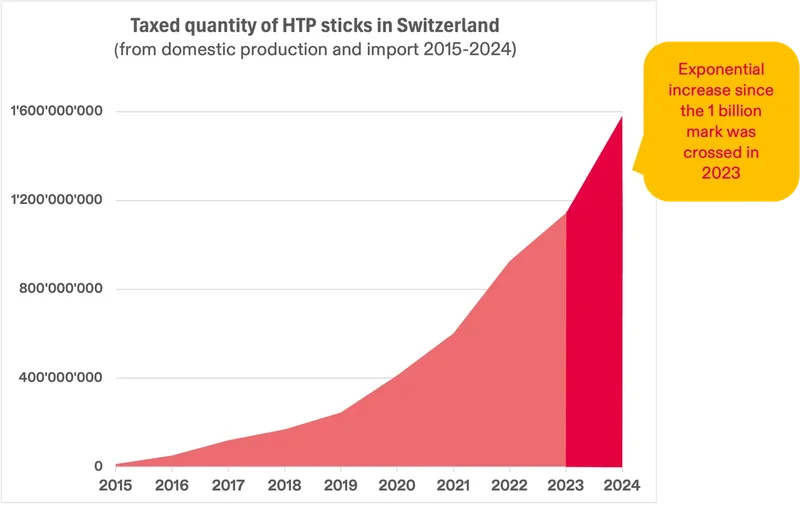

Heated tobacco products have become a major segment of the Swiss market. In 2024, no fewer than 1.5 billion sticks were sold in the country, equivalent to 75 million packs of 20 units. These packs sell for an average of CHF 8.80 each.

AT Schweiz

Image 2: Quantities of heated tobacco products sold in Switzerland: https://www.at-schweiz.ch/fr/connaissances/produits/produits-a-tabac-chauffe/

However, unlike traditional cigarettes, these products are subject to a tax rate of only 16%. According to calculations by AT Switzerland, this reduced taxation generated approximately CHF 105.6 million in revenue in 2024. While this amount may seem considerable at first glance, it is in reality far below what a consistent tax treatment would yield.

If heated tobacco sticks were taxed at the same rate as cigarettes—50.1%—tax revenues would have reached more than CHF 330 million. In other words, the Swiss Confederation forfeits approximately CHF 225 million each year by allowing this tax disparity to persist.

As already mentioned, this difference stems from a classification inherited from the Tobacco Tax Act, which categorises heated tobacco sticks as "other tobacco products". This distinction is entirely arbitrary.

Given the spectacular growth in sales of heated tobacco products in Switzerland, it is entirely plausible that the volume will already exceed 2.5 billion sticks per year in 2025. In such a scenario, and applying the same tax rate as for cigarettes (50.1%), the tax revenue would reach nearly CHF 551 million. In other words, Switzerland would then be foregoing more than CHF 375 million in revenue per year, a colossal loss directly linked to the current under-taxation of heated tobacco products.

In summary, the Federal Council's response regarding the taxation of heated tobacco products is based on arguments that are largely biased, unsubstantiated, or exaggerated. This simply allows the industry to maximise its profits on products that are just as dangerous as cigarettes, thus benefiting from preferential tax treatment.

Taxing snus and nicotine pouches

The second parliamentary motion rejected by the Federal Council is that of National Councillor Patrick Hässig, which concerns the taxation of snus and nicotine pouches[xii]. First, it's important to remember that snus is banned in the European Union (with the exception of Sweden) and was also banned in Switzerland until 2019. Nicotine pouches were specifically developed by the tobacco industry to circumvent these European bans[xiii].

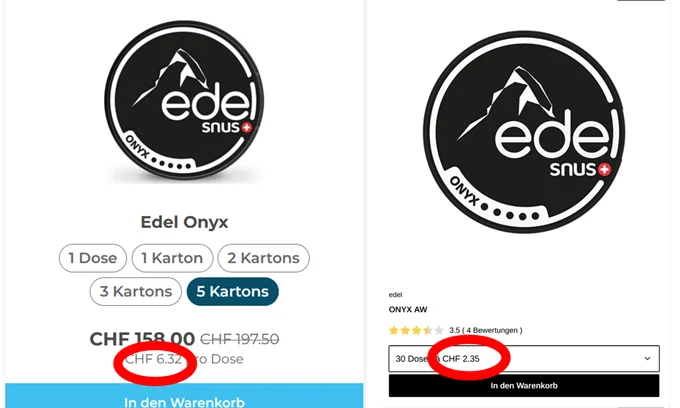

In their response – which is little more than a copy-and-paste of the previous negative response – the Federal Council once again trot out the bogeyman of the black market. Other questionable elements are also included. For example, they state that "a box of snus or tobacco-free nicotine pouches costs an average of CHF 7.95". It is unclear how this price was calculated, or how it is relevant to the discussion of the tax level. Given that the Federal Council's entire argument rests on this "average" price (the Federal Council begin their response with this), it seems essential to examine it more closely.

The true price of a box of snus or nicotine pouches

Currently, it's true that some of the most expensive brands can reach prices of up to CHF 10.90 per can, particularly for certain Velo products sold on the Kkiosk.ch website. However, as with most online platforms, the dominant sales strategy involves offering significant discounts on multipack purchases. For example, buying five cartons (25 cans) of Elf Cool Storm Pouches 20 mg immediately lowers the unit price to CHF 6.32. It's also worth noting that Kkiosk – a company belonging to the Valora group – is one of the most expensive retailers on the market. On many Swiss websites, prices per can are significantly lower, often around CHF 5, and can easily drop even further.

On a major online retailer like SnusMarkt.ch, a single can rarely costs more than CHF 5 (for example, Velo Crispy Peppermint at CHF 5.09). However, when buying in multipacks, prices drop drastically: purchasing 120 cans of the same product brings the unit price down to CHF 3.32. In reality, it's highly unlikely that a customer would order just one can of snus online. The market largely relies on bulk purchases, which makes the "average price" presented by the Federal Council not only questionable but also completely out of touch with the commercial reality of the sector.

Screenshot AT Suisse

Image 3: Comparison: on the Kkiosk.ch website, a can of Edel Onyx snus is sold for CHF 7.90, but if you buy 25 cans at once, the unit price drops to CHF 6.32. On a much cheaper website, Snushus.ch, the same can is sold for CHF 2.95, but if you buy 30 cans at once, the unit price drops to CHF 2.35. (Website Information verified on 01.12.2025)

Regarding snus prices, it's also important to consider a fairly common practice that is largely unknown to the general public: the use of "mega-boxes". Some brands, such as Siberia, sell 500-gram containers holding approximately 625 pouches. These large containers, available for example for CHF 124.99, significantly reduce the unit price to about CHF 0.20 per pouch—less than half the cost of a pouch sold in a standard 20-unit box.

These large formats profoundly alter the actual price structure: they make snus significantly cheaper than it appears if one only considers the standard small tins. They also show that regular users—those whose use carries the greatest risk of addiction—have easy access to large quantities at particularly low prices. To accurately assess the fiscal and health impact of these products, it is therefore essential to incorporate these commercial practices into the analysis.

AT Suisse

Image 4: https://www.snusexpress.ch/de/brands/siberia/siberia-extremely-strong-white-dry-500g-1595 (consulted on 01.12.2025)

Regarding the "average" price, we question how the Federal Council arrived at their calculations. Not only is it highly improbable that CHF 7.95 reflects a true average market price, but everything indicates that it is actually closer to – or even below – CHF 5, given the significant volume of online sales, where prices are systematically reduced and decrease further depending on the quantities purchased.

The actual price of a box of nicotine pouches on online sales platforms is often half the price quoted by the Federal Council. How is it that the Federal Council seems to be so poorly informed about this market?

In this context, it would be essential to know the exact methodology used by the Federal Council to determine this amount: what sources were consulted? What types of retail outlets were included? Does the calculation include multi-pack purchases, which are prevalent online? Without this information, the figure presented appears opaque and cannot serve as a solid basis for a tax argument.

Black market for snus? Really??

As in its response concerning heated tobacco products, the Federal Council invoke the risk of a black market developing or of cross-border purchases for snus. This argument is simply absurd: all of Switzerland's neighbouring countries prohibit the sale of snus. A Swiss consumer would have to travel more than 1,000 km to reach Sweden, the nearest country where snus is legally sold. In other words, the idea of "snus tourism" or massive parallel trade is more a matter of industry rhetoric than a real risk.

To buy cheaper snus, Swiss consumers can cross the border and go ... to Sweden!!!

As with other tobacco products, the bogeyman of the black market is largely a product of tobacco industry propaganda.

The Federal Council also seem to fear that a significant price increase for nicotine pouches would lead to the development of a largely imaginary black market – even though in Switzerland there is practically no black market for cigarettes either, despite their high price.

The Federal Council also state that "in the past, the gradual increase in taxes has proven effective and has led to a continuous increase in tax revenues." Should this be interpreted as meaning that they would therefore be in favour of regular and planned increases in taxation on snus and nicotine pouches? This is a well-established strategy in many countries, which adjust their taxes year after year precisely to maintain the effectiveness of their pricing policy.

However, it's important to remember that in Switzerland, such a strategy isn't even applied to cigarettes: taxation has been completely frozen since 2013. The tobacco lobby has successfully prevented any increases in Parliament, thus paralysing one of the most effective public health instruments. In this context, the Federal Council's reference to "gradual increases" seems paradoxical, to say the least.

Expand funding for prevention to all tobacco and nicotine products

The motion by National Councillor Yvonne Bürgin aimed to finance tobacco prevention through a tax applied to all tobacco and nicotine products[xiv]. Currently, new products—snus, nicotine pouches, and e-cigarettes—do not contribute at all to the Tobacco Prevention Fund, even though they are increasingly becoming gateways to nicotine addiction, particularly among young people. This motion also highlights a now well-known paradox: while these new products are spreading rapidly, the resources allocated to prevention are stagnating or decreasing. Introducing a specific contribution would help restore some balance.

The aim here was not to create a new, dedicated tax – an option to which Parliament is generally opposed – but simply to extend an existing tax to other products and thus strengthen the resources allocated to tobacco prevention, which are currently constantly dwindling.

The Federal Council nevertheless rejected this motion, pointing out that a report is already underway to assess the possibility of extending the contribution to the Prevention Fund to all tobacco products. Once this report is submitted, the decision will again rest with Parliament—where the tobacco lobby will, as usual, deploy every possible means and argument, including the most fallacious ones, to prevent any measure likely to increase taxation or strengthen prevention efforts.

[i] https://www.at-schweiz.ch/fr/plaidoyer/prix-taxes/taxe-sur-le-tabac/

[ii] https://www.at-schweiz.ch/fr/connaissances/produits/produits-a-tabac-chauffe/

[iii] https://www.parlament.ch/fr/ratsbetrieb/suche-curia-vista/geschaeft?AffairId=20254277

[iv] European site consulted on 01.12.2025: https://smog-store.com/fr/terea/

[v] Kkiosk site consulted on 01.12.2025: https://tabak.kkiosk.ch/products/iqos-iluma-terea-turquoise

[vii] Tobacco Atlas (2023) Illicit Trade. Online: https://tobaccoatlas.org/challenges/illicit-trade/, consulted on 04.11.2024.

[viii] Gallagher, Allen W. A.; Evans-Reeves, Karen A.; Hatchard, Jenny L.; Gilmore, Anna B. (2019) Tobacco industry data on illicit tobacco trade: a systematic review of existing assessments. In: Tobacco Control, vol. 28, n° 3, p. 334–345. DOI: 10.1136/tobaccocontrol-2018-054295.

[ix] https://www.economicsforhealth.org/files/research/553/Illicit-Trade-Policy-Brief_v2.1-1.pdf

[xi] https://www.at-schweiz.ch/fr/blog-at/95/

[xii] https://www.parlament.ch/fr/ratsbetrieb/suche-curia-vista/geschaeft?AffairId=20254295

[xiii] https://www.at-schweiz.ch/fr/connaissances/produits/snus-et-autres-formes-de-tabac-oral/

[xiv] https://www.parlament.ch/fr/ratsbetrieb/suche-curia-vista/geschaeft?AffairId=20254298